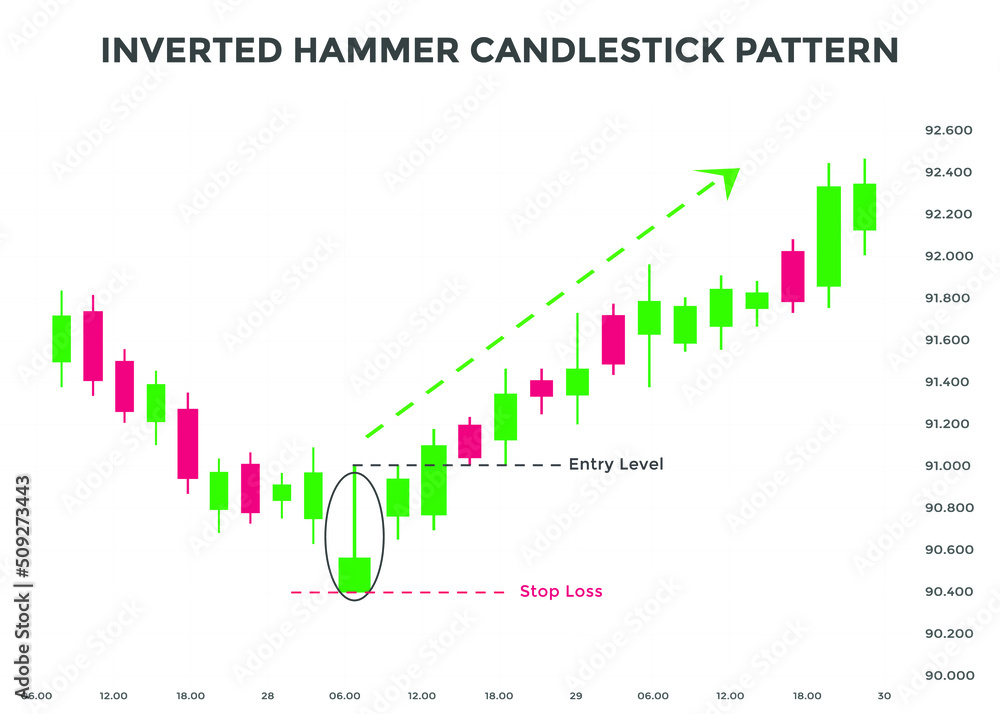

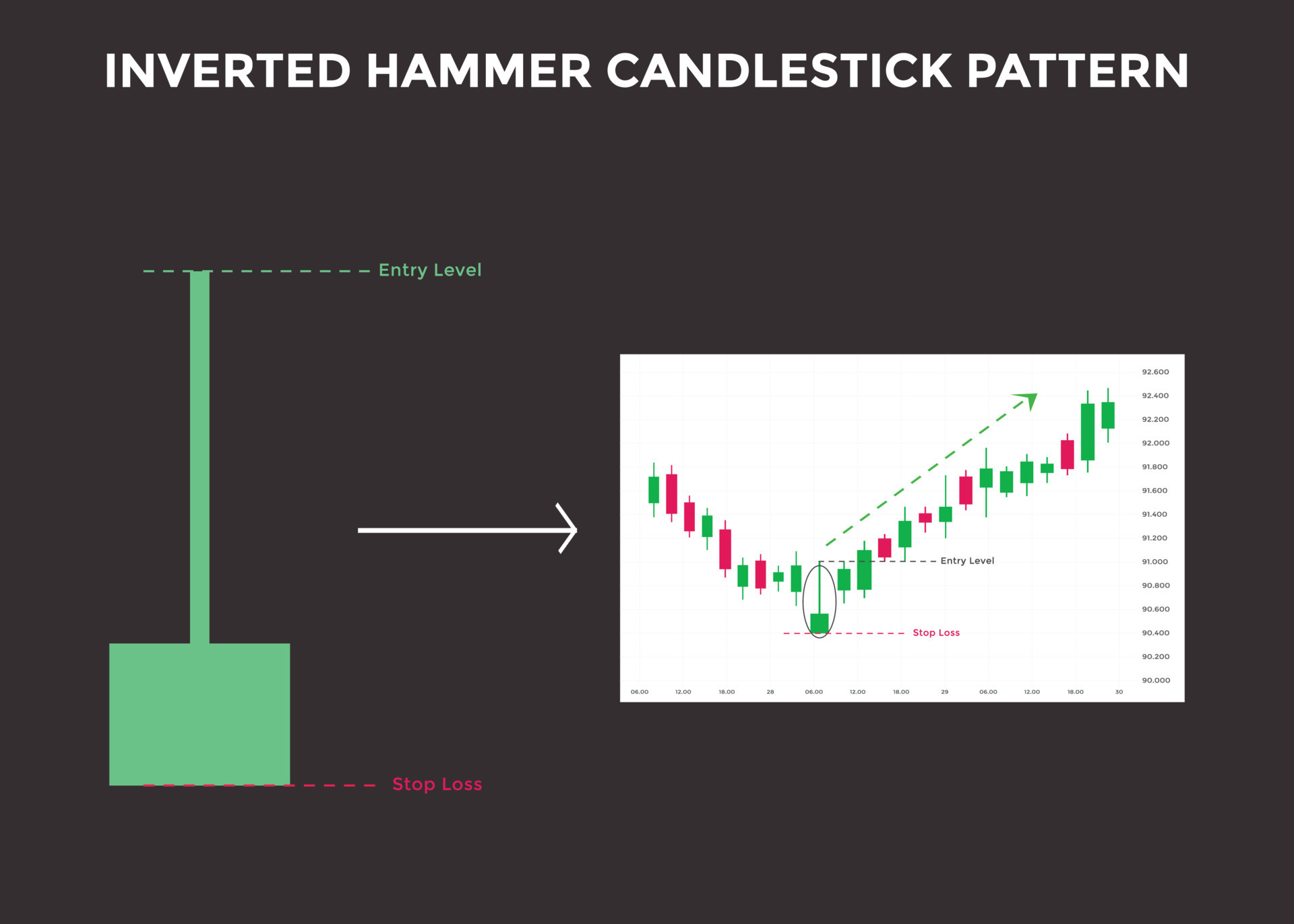

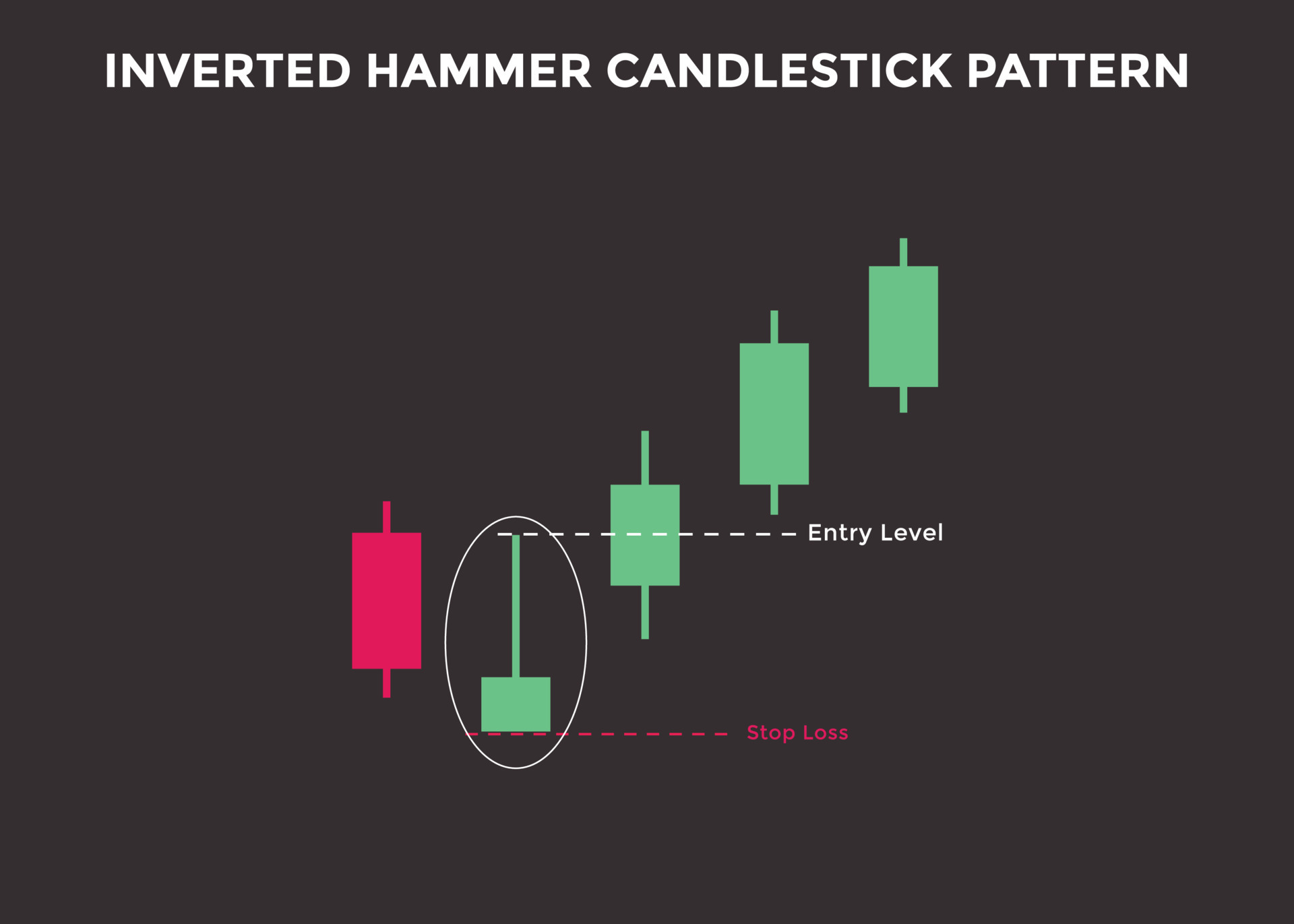

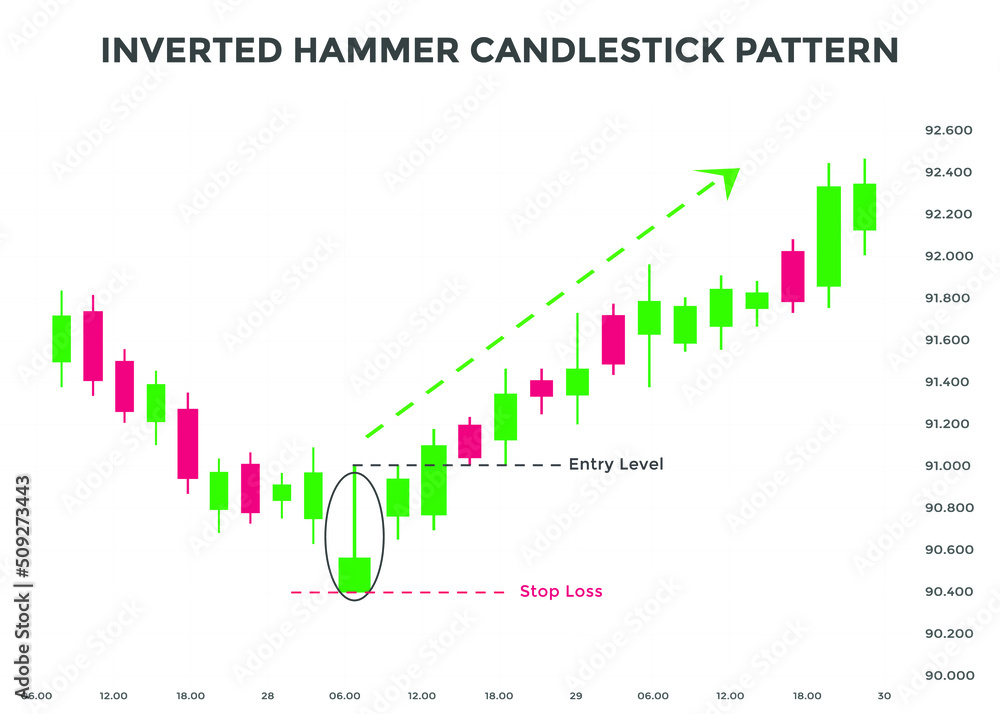

chart pattern inverted hammer. What is an inverted hammer? The inverted hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

chart pattern inverted hammer Inverted hammer is a single candle which appears when a stock is in a downtrend. It’s an important candle because it can potentially reverse the. What is an inverted hammer candlestick?

The Inverted Hammer Candlestick Pattern Is A Unique Stock Chart Pattern That Showcases A Trend Reversal.

In this article, we’re going to have a closer look at the inverted hammer pattern. What is an inverted hammer candlestick? We’re going to cover it’s meaning, how you spot one, some examples, and also a couple of trading.

What Is An Inverted Hammer?

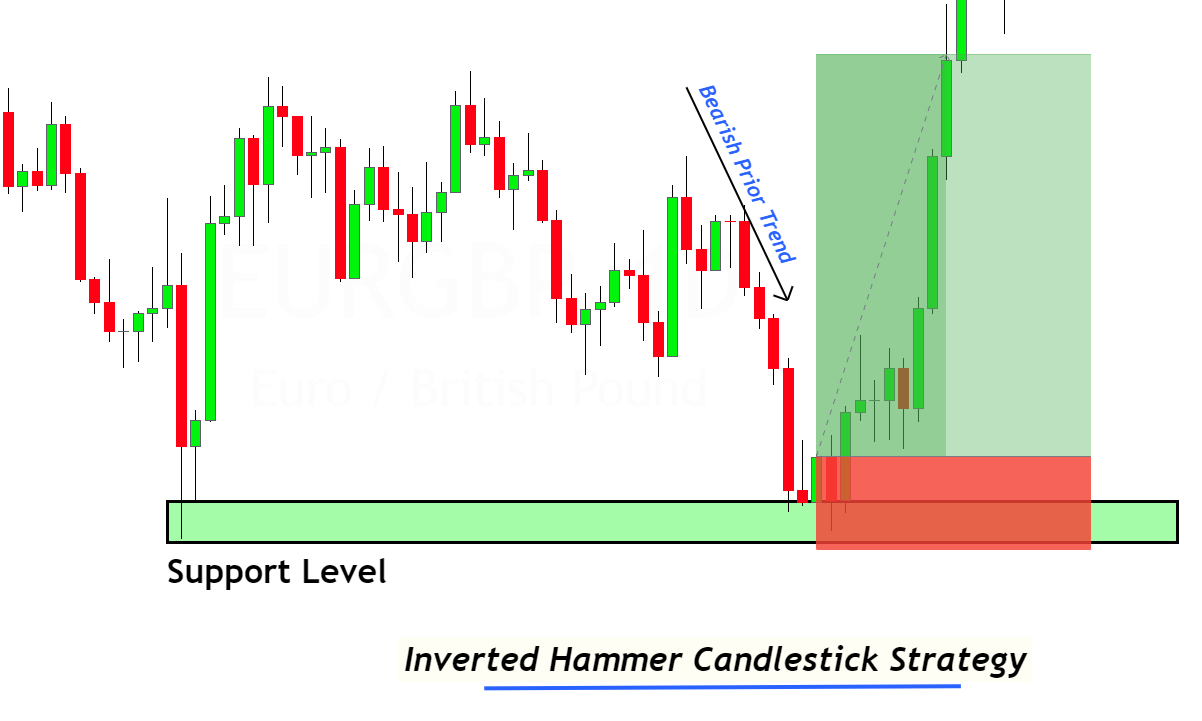

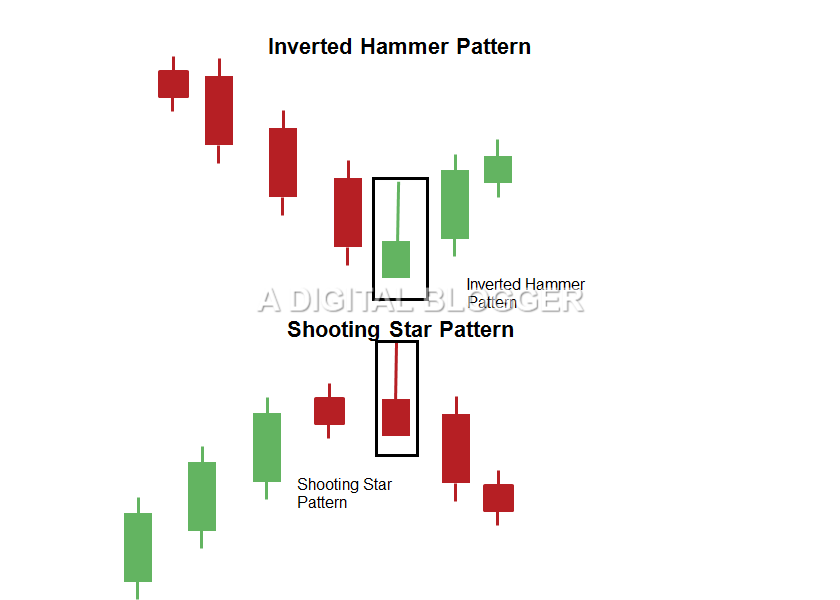

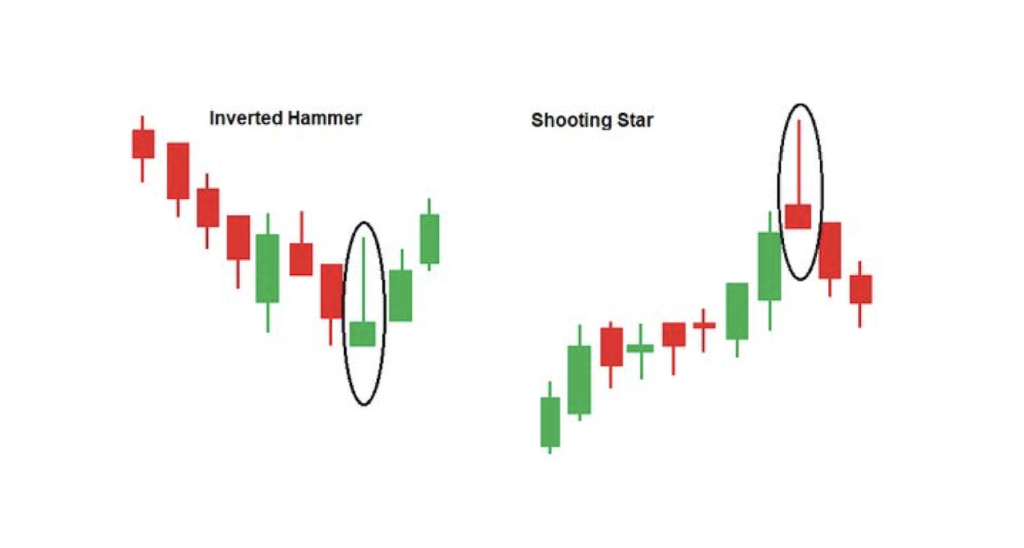

The inverted hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift. The inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a. It’s an important candle because it can potentially reverse the.

Inverted Hammer Is A Single Candle Which Appears When A Stock Is In A Downtrend.

It is a candlestick pattern, which is represented as an inverse hammer, with the body of the candlestick being. Stockbrokers and investors look for this trend to make a trade. The inverted hammer candlestick pattern is a bullish reversal chart pattern used for technical.