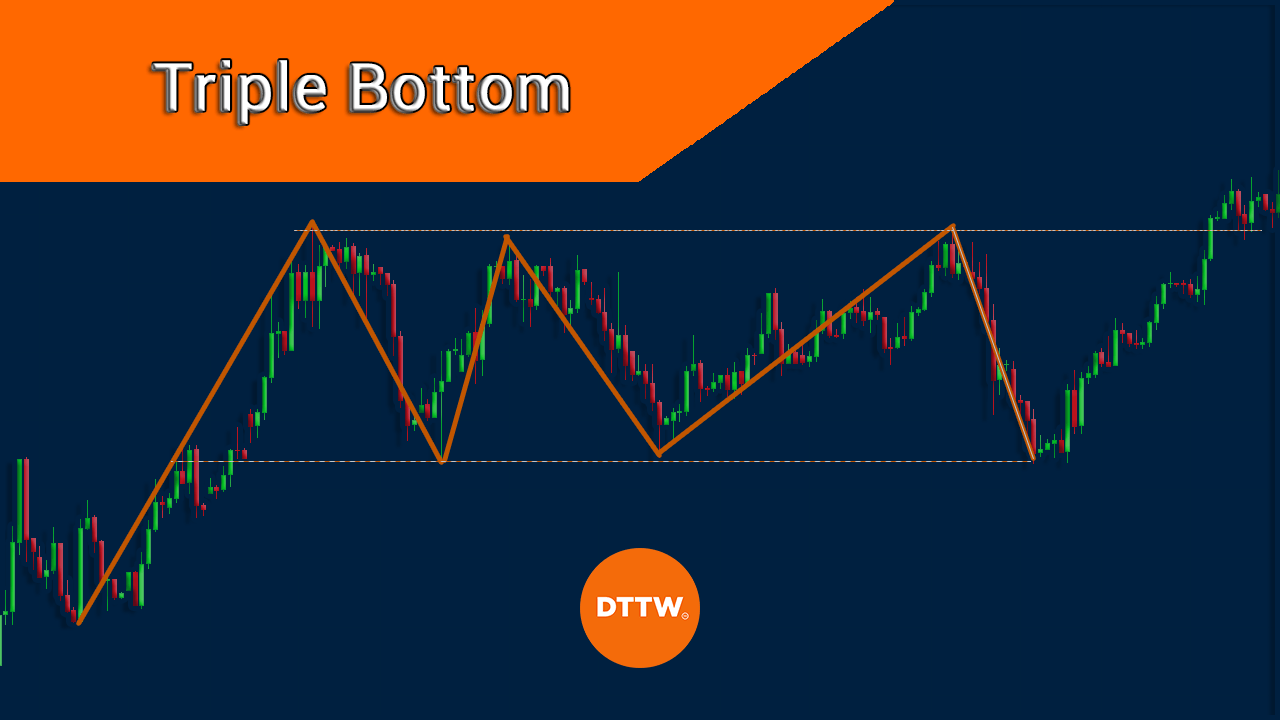

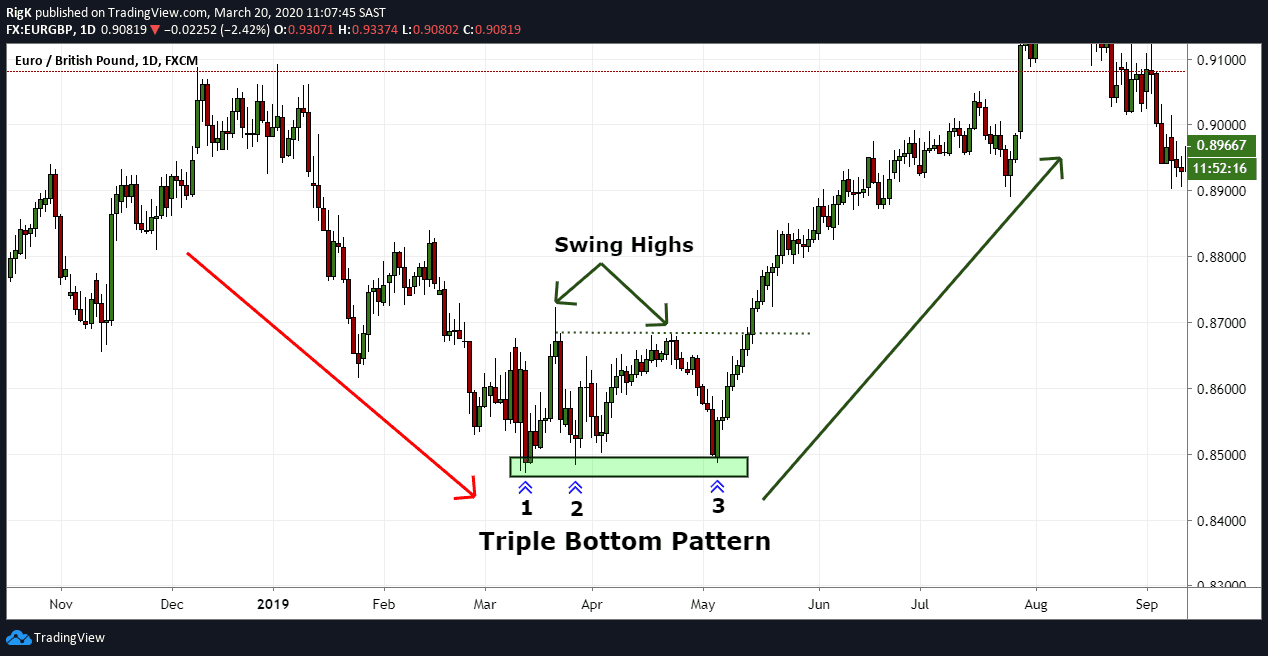

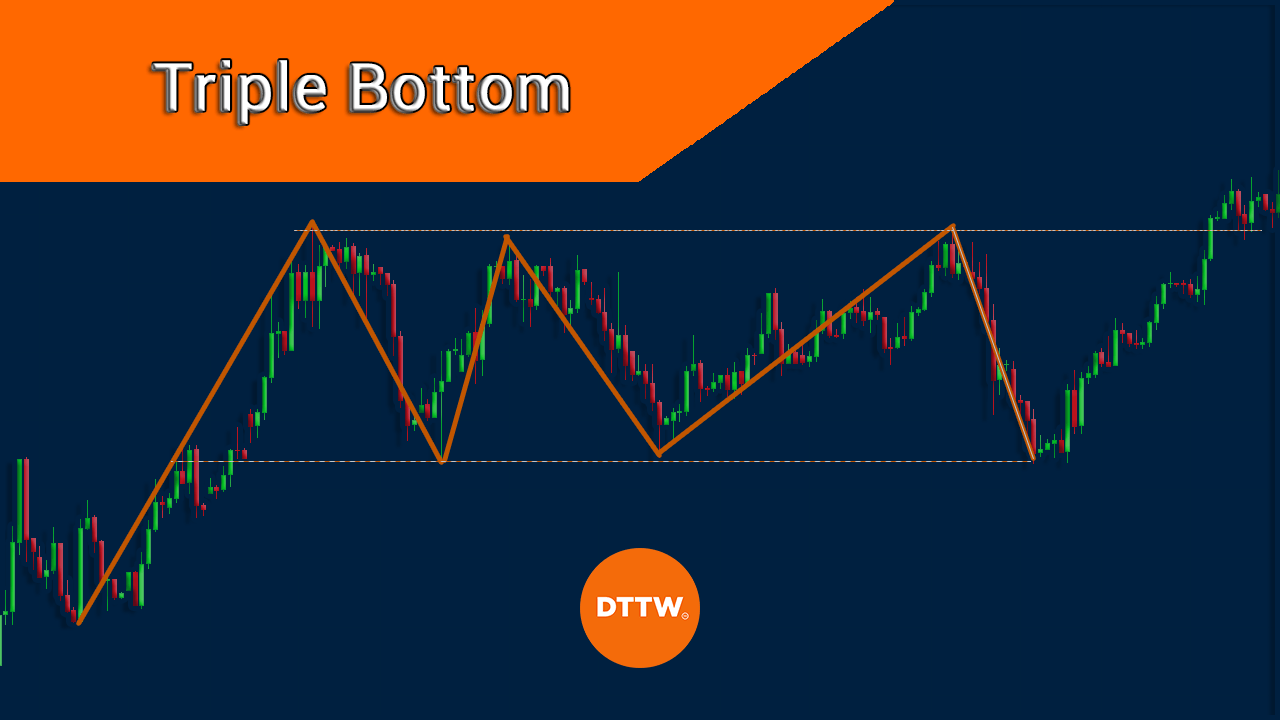

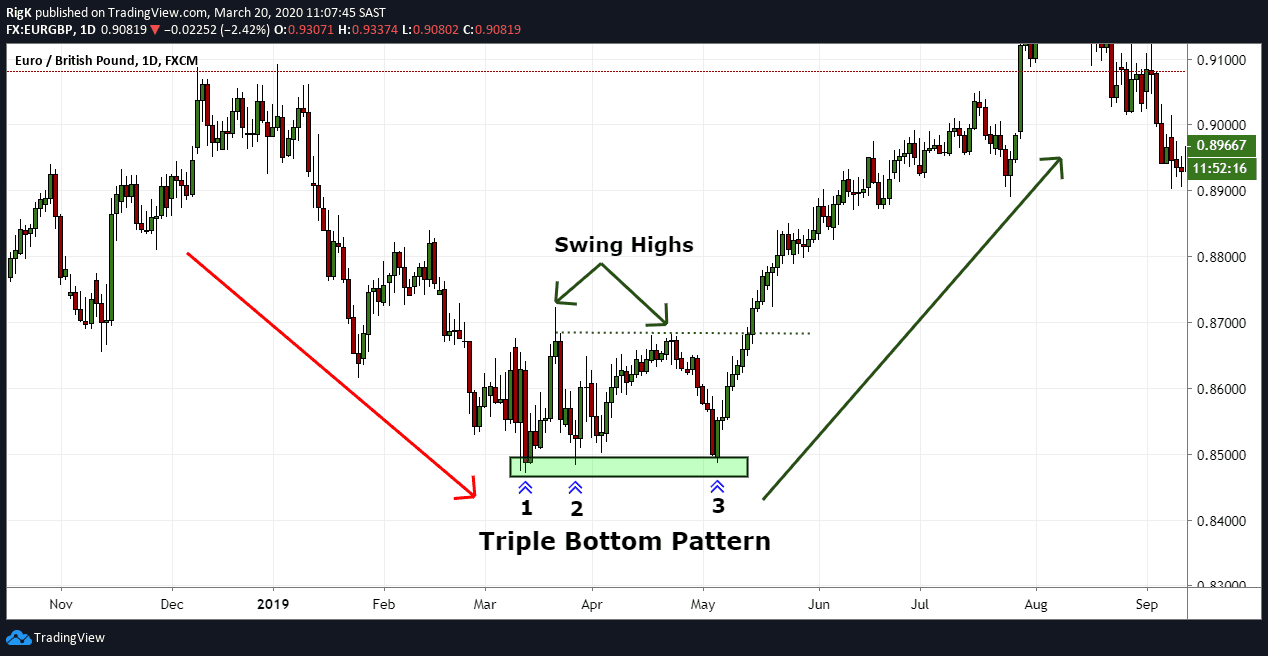

chart pattern triple bottom. A triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. A triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers.

chart pattern triple bottom A triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. A triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. A triple bottom chart is a bullish reversal pattern that forms after a downtrend and signals a shift in market momentum.

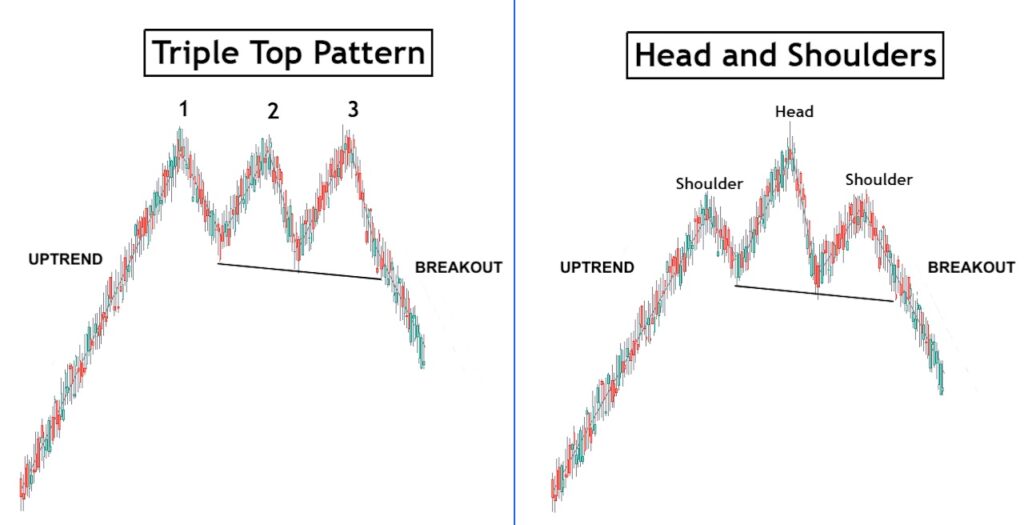

Much Like Its Twin, The Triple Top Pattern , It Is Considered One Of The Most Reliable And Accurate Chart Patterns And Is Fairly Easy To Identify On Trading Charts.

A triple bottom chart is a bullish reversal pattern that forms after a downtrend and signals a shift in market momentum. In technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. What is the triple bottom pattern?

The Triple Bottom Pattern Offers A Second Chance For Traders Who Missed The Double Bottom Opportunity.

A triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Triple bottom pattern is a bullish reversal chart pattern. It consists of a neckline.

A Triple Bottom Is A Chart Pattern Used For Technical Analysis, Which Shows The Buyers Are Taking Control Of The Price Action From The Sellers.

The triple bottom chart pattern is formed after a. It consists of 3 swing low levels in the price and it signals that a bearish trend may be ending and the price may reverse to a new bullish trend. The pattern consists of three equal lows, followed.

Learn The Triple Bottom Chart Pattern Definition And Understand How To Identify And.

The triple bottom pattern is a bullish reversal formation that appears after a sustained.