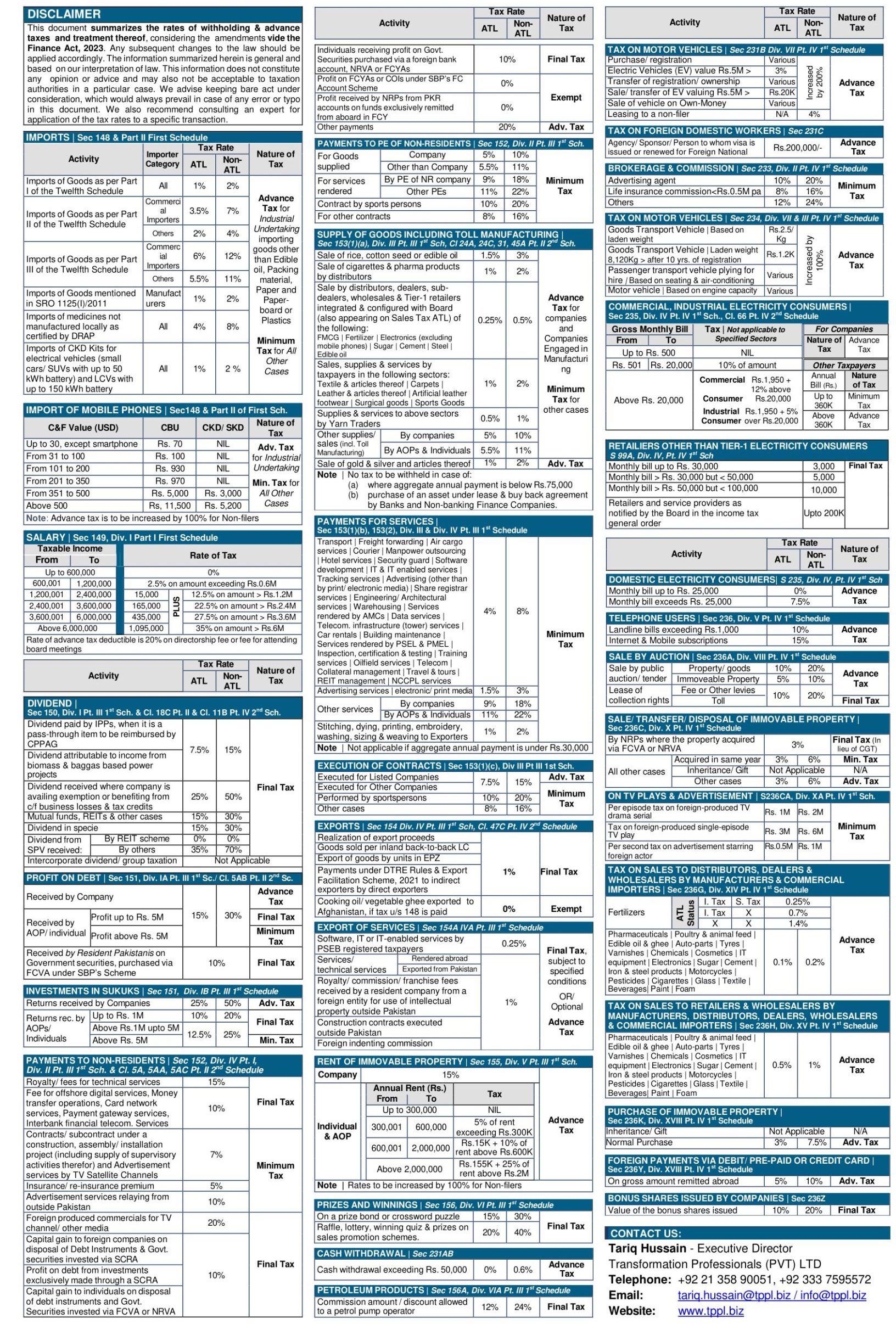

withholding tax chart 2025. The primary purpose of this document is to help. Deloitte india insights on india's union budget 2025 expectations, focusing on direct tax slab in budget 2025, including settlement schemes for.

withholding tax chart 2025 Deloitte india insights on india's union budget 2025 expectations, focusing on direct tax slab in budget 2025, including settlement schemes for. It contains tables or charts providing information on tax rates for different income levels. The tax rates applicable to different categories of taxpayers, such as individuals, hufs, aops, bois, and companies, vary based on the nature of the taxpayer and the source of income.

Deloitte India Insights On India's Union Budget 2025 Expectations, Focusing On Direct Tax Slab In Budget 2025, Including Settlement Schemes For.

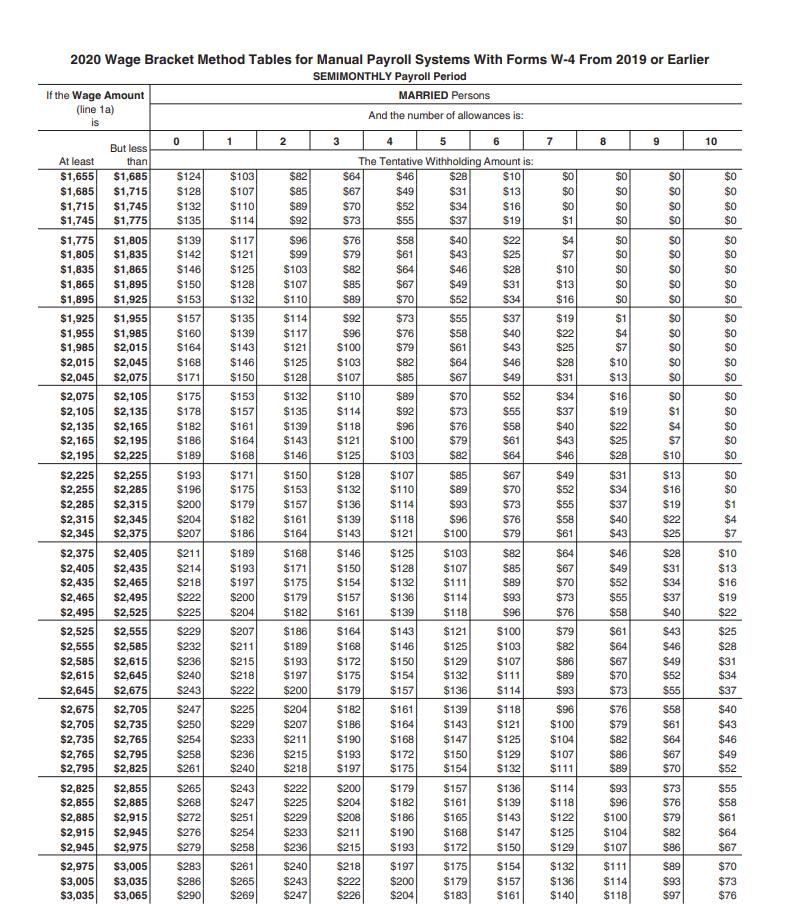

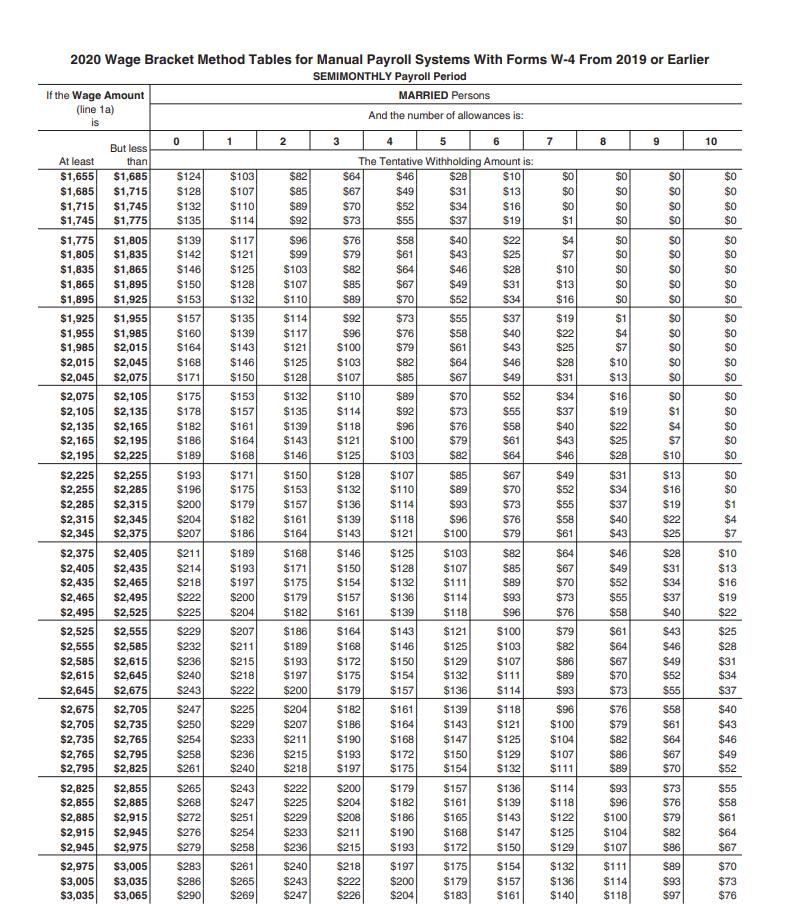

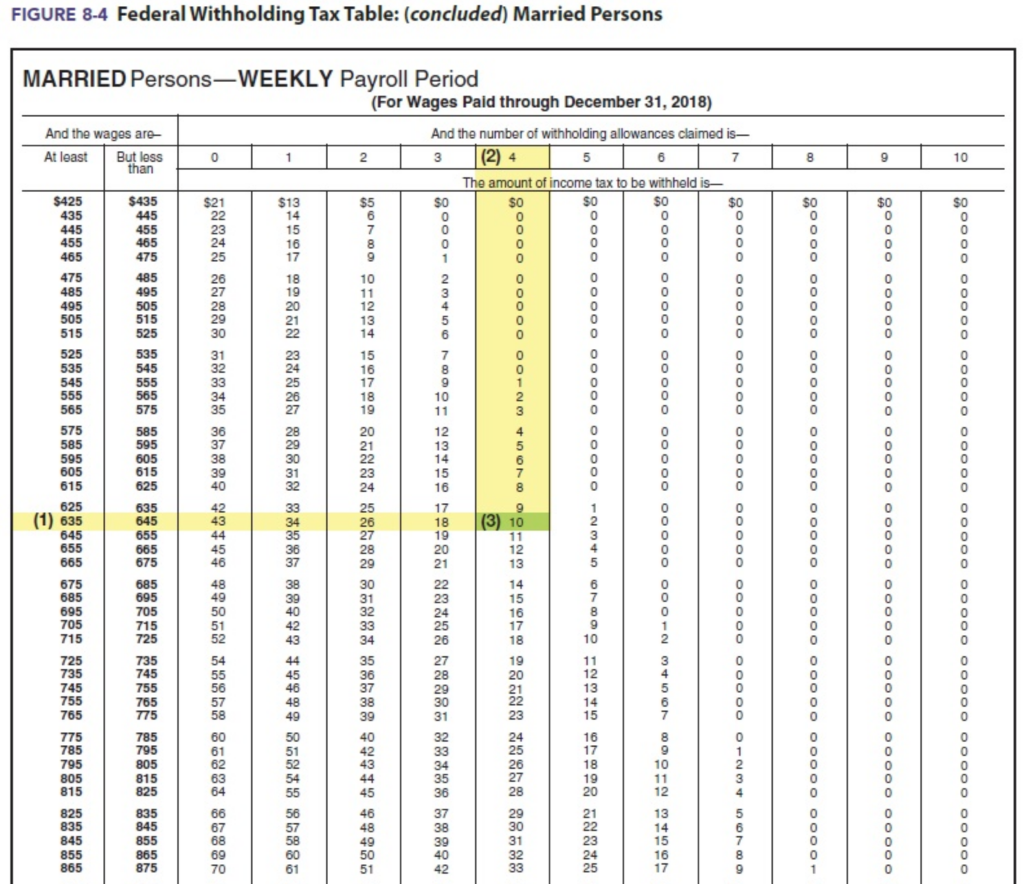

Section 1 of this publication includes worksheet 1b for payers to figure withholding on periodic payments of pensions and annuities based on a. The primary purpose of this document is to help. It contains tables or charts providing information on tax rates for different income levels.

The Tax Rates Applicable To Different Categories Of Taxpayers, Such As Individuals, Hufs, Aops, Bois, And Companies, Vary Based On The Nature Of The Taxpayer And The Source Of Income.

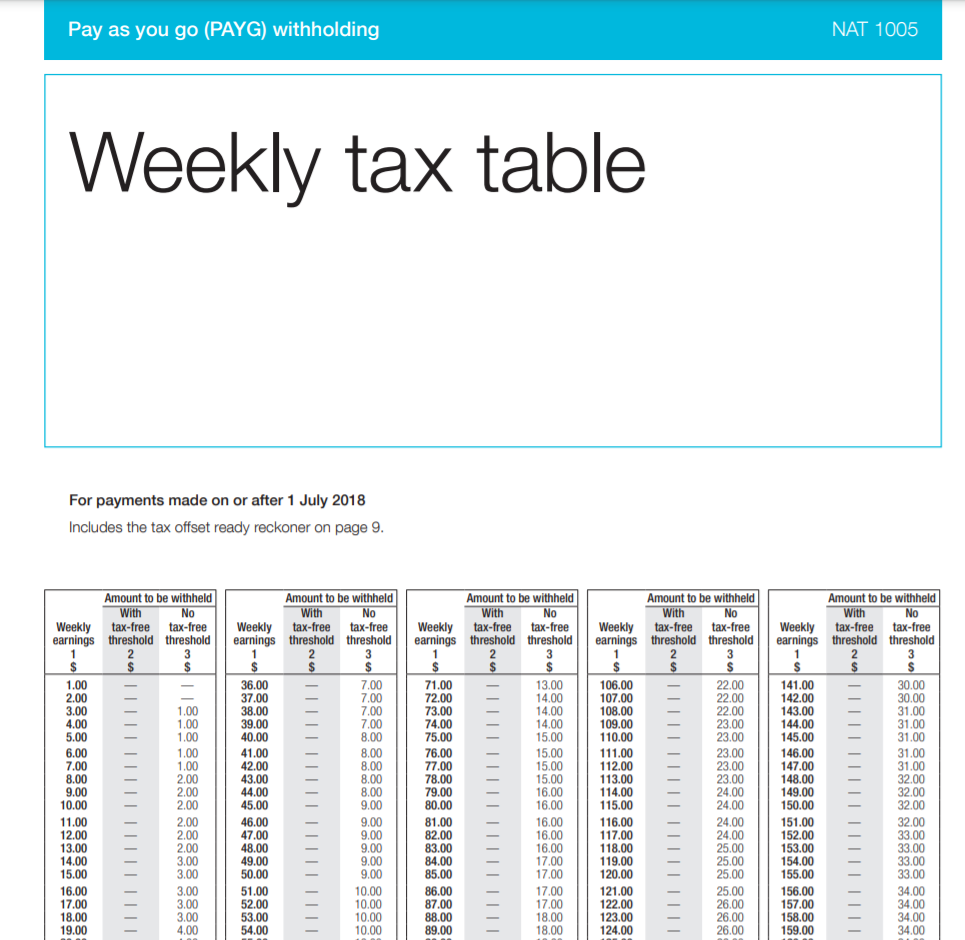

Withholding tax in india, also known as tax deducted at source (tds), is a way to collect taxes at the point where income is generated. Withholding tax collection / deduction rate card for tax year 2025